extended child tax credit dates

The enhanced child tax credit expired at the end of December. Ad Receive the Child Tax Credit on your 2021 Return.

Oct 15 Is Tax Deadline For Extended 2020 Tax Returns

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. Your amount changes based on the age of your. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. In 2021 and 2022 the average family will receive 5086 in coronavirus stimulus money thanks to the expanded child tax credit. Child Tax Credit amounts will be different for each family.

The Joint Committee on Taxation estimated that the 2021 advance child tax credits expansion would cost 110 billion. Heres an overview of what to know. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

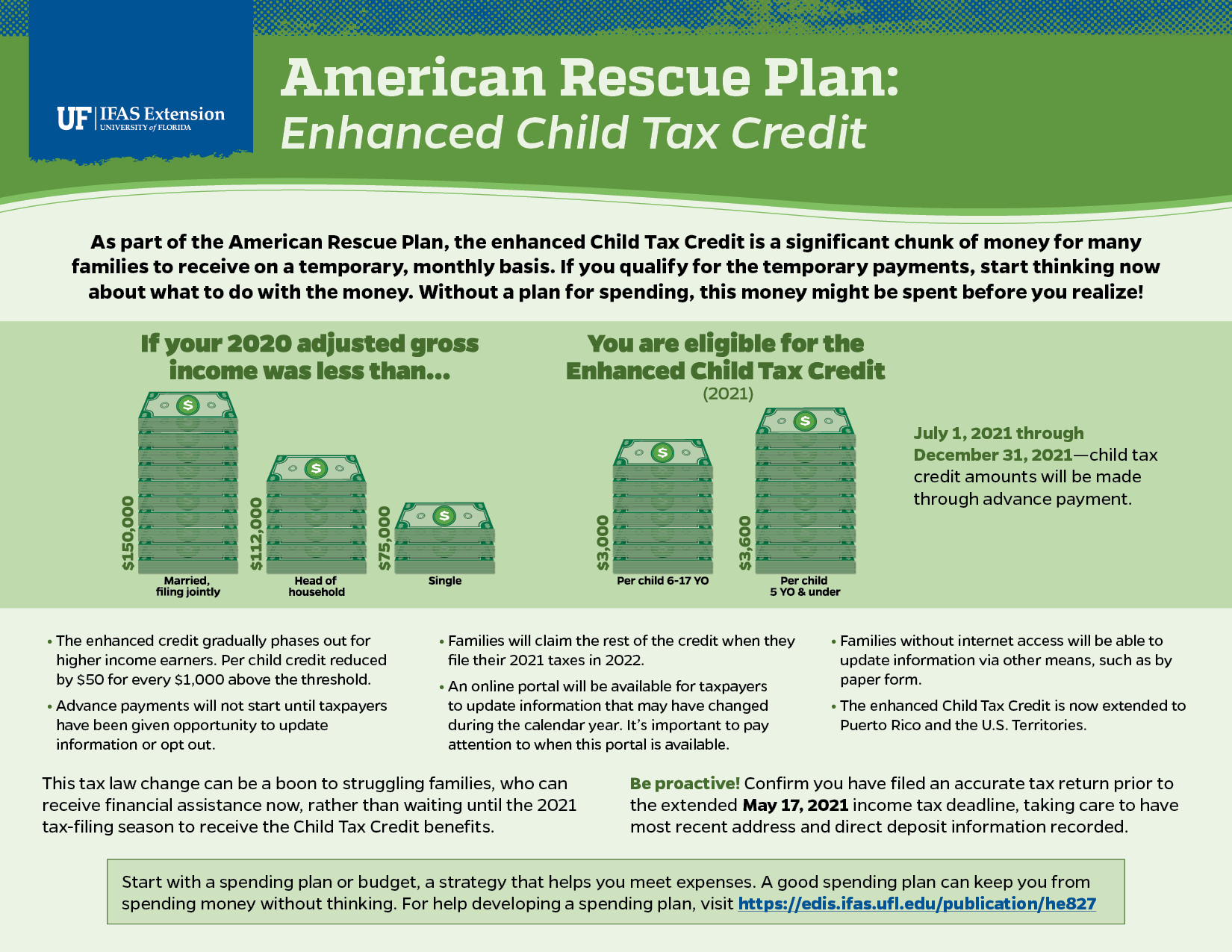

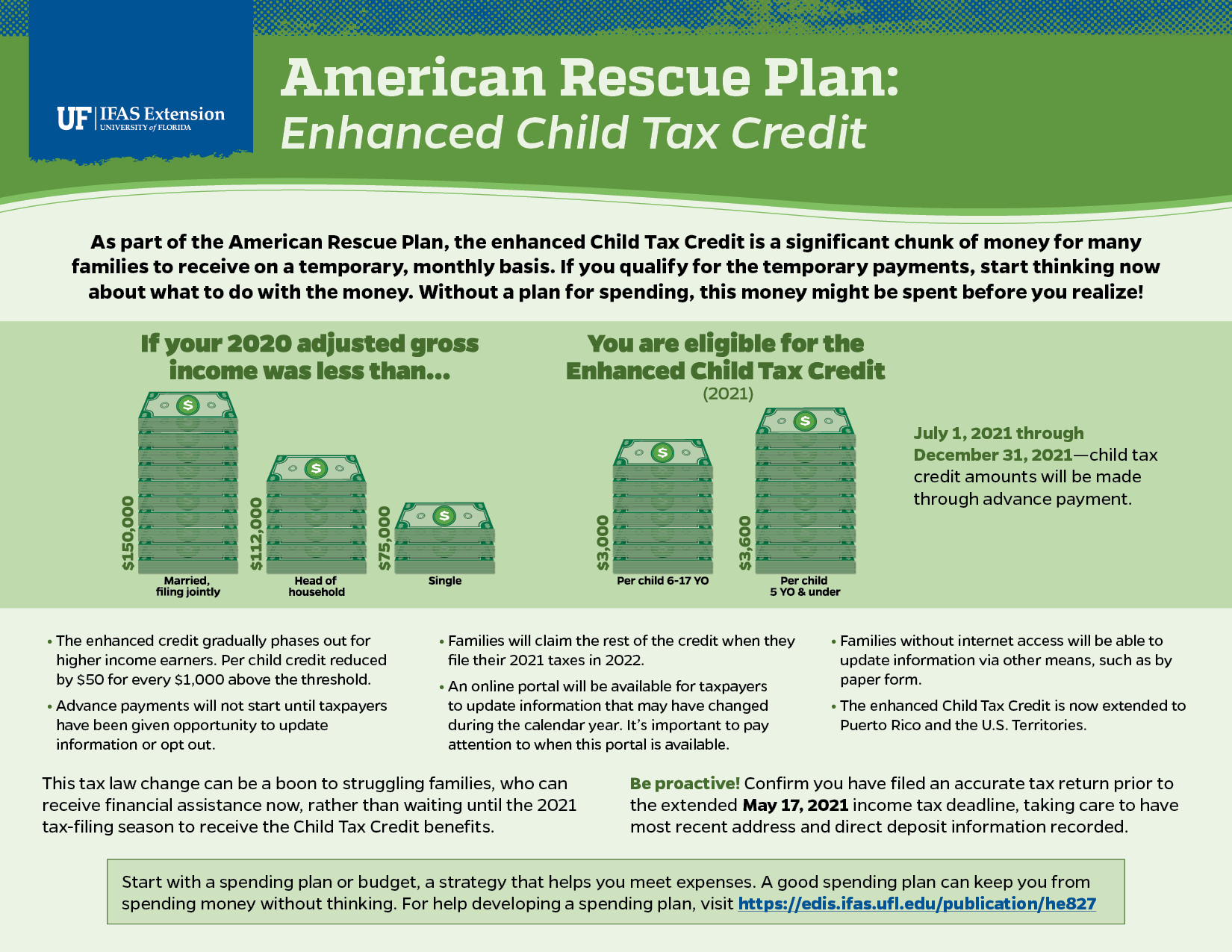

The remainder of your money will come with your tax refund this year after you file your 2021 tax return. See what makes us different. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

For children under age 6. File Federal Taxes to the IRS online 100 Free. Visit ChildTaxCreditgov for details.

The legislation made the existing 2000. For children age 6 through 17. While the IRS did extend the 2020 and 2021 tax filing dates due to the.

Congress is out of session for the holidays but will. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600.

To be a qualifying child for. The 6 monthly Child Tax Credit payment amounts will total. They could also get up to 250 per qualifying child between 6 and 17 years or a total of 3000.

This money was authorized by the American Rescue Plan. 15 opt out by Aug. Now if the current payment amounts do not pass in Congress moving forward eligible parents can only receive a once-a-year maximum credit per child come tax time -- 1000 for.

We dont make judgments or prescribe specific policies. This means that the total advanced credit. For parents who opted out of the advanced child tax credit payments in 2021 they will be able to claim the full credit if they qualify on their 2021 tax return.

As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous. If it had been extended the next monthly child tax credit payments would have been set to go out to families on Jan. 13 opt out by Aug.

The cost of extending it until 2025 has been estimated at. New 2021 Child Tax Credit and advance payment details. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300.

Unless Congress takes action the 2020 tax credit rules apply in 2022. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. The IRS will send out the next round of child tax credit payments on October.

Dates For The Advanced Child Tax Credit Payments

2020 Tax Filing Will Determine Child Tax Credit Periodic Payments In 2021 Early Childhood Alliance

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

American Rescue Plan Enhanced Child Tax Credit Living Well In The Panhandle

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423371/GettyImages_1328589075.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Why Is There No Child Tax Credit Check This Month King5 Com

Stimulus Update Will Child Tax Credit Monthly Payments Restart Al Com

Last Day To Unenroll In July Advanced Child Tax Credit Payment

Child Tax Credit Payment Schedule For 2021 Kiplinger

Will Monthly Child Tax Credit Be Extended Into 2022 Motherly

What To Know About 3 600 Child Tax Credit Dates Eligibility Amount As Usa

Ohio Families May Lose Thousands If Child Tax Credit Not Extended

Will Child Tax Credit Payments Be Extended In 2022 Money

45l Tax Credit Extended For 2021 Homes Ducttesters Inc

A Coalition Of Mothers Urge Biden Make The Child Tax Credit Permanent Ms Magazine